TAMPA, Fla. — Elizabeth Roache of Hudson paid her homeowners insurance of $800 a year for a decade before she saw what many Floridians have seen, homeowners insurance premiums on the rise.

Starting in 2020, Roache saw her yearly premium jump to $1,100 and then to $1,500 in 2021.

“We were just like what’s going on? No biggie. We need to keep our homeowners insurance," Roache said. "This year we received our statement and it has gone up to $1900. That is almost three times as it was two years ago. And it really just makes you wonder what is going on here."

Roache finally turned to the company many in Florida end up with, Citizens Insurance. She was able to get a $1,900 premium with Citizens after being quoted rates as high as $6,000 a year from other companies.

“It does make us wonder, is there going to be another increase next year? We don’t know what to anticipate,” said Roache.

Those increases forced some homeowners to sell their homes, move to another area if possible, or buy the bare minimum policy needed to keep their homes. Overall, Insurance.com estimated the average home insurance premium in Florida was $3,600 — $1,300 more than the national average.

What is driving the seemingly never-ending rises in homeowners insurance?

Experts said the crisis is being driven by fraud, lawsuits, and skyrocketing property values.

Two men were arrested this month in Naples for operating a scheme for free roof replacements involving claims to their insurers. Overall, Florida saw more than 100,000 property claim lawsuits last year.

Put another way, 82 percent of all US home insurance litigation happened in Florida last year.

It's all come together to create a perfect storm of a homeowners insurance crisis. And as the crisis continues to swallow up Florida homeowners, the state legislature adjourned the regular session without taking major action to combat the problem.

State Senator Jeff Brandes has been outspoken on the issue and said more needs to be done.

“We are at collapse. We are beyond crisis. Crisis was three years ago.”

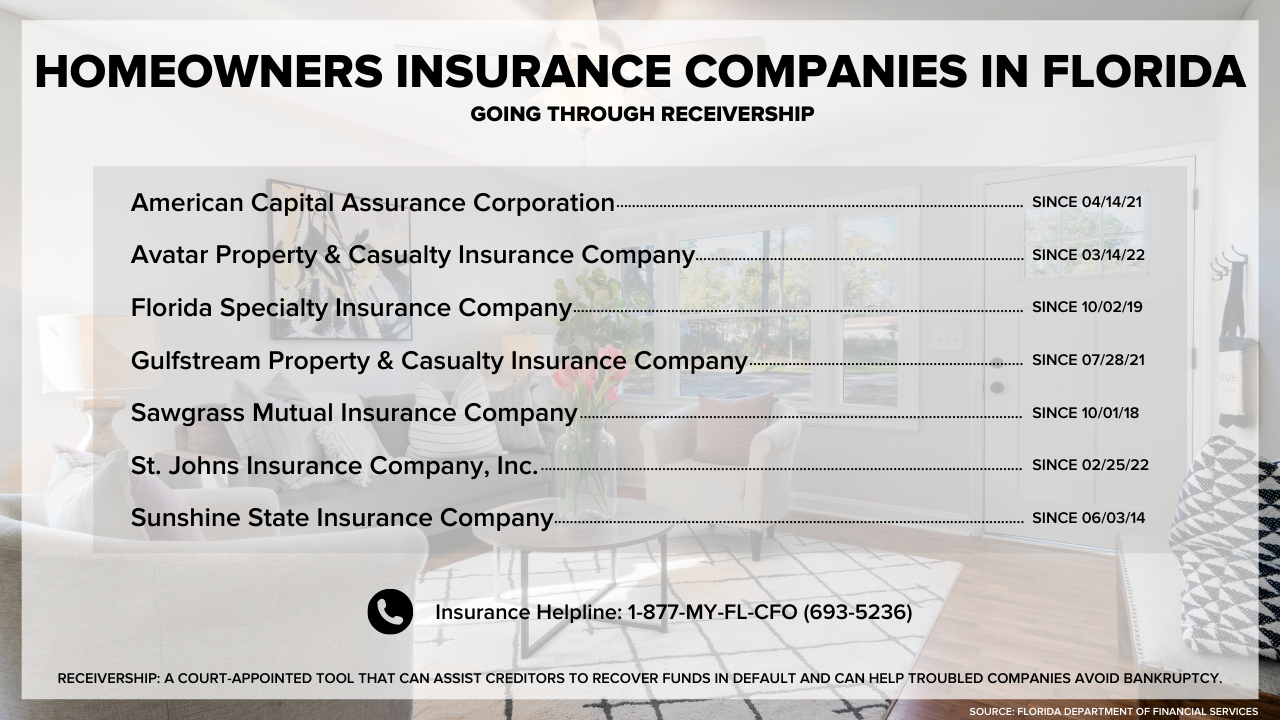

Brandes said insurance companies are beginning to fail, and there are no investors who want to support them. Numbers from the state back that claim up. Since 2014, seven homeowners insurance companies have gone through various phases of the receiver process.

With private insurers running into problems in the state, that sends more and more Floridians to government-subsidized insurance with Citizens.

“You have this perfect storm of things. The legislature sitting on the sidelines. A Governor who has not engaged at the level that he needs to. Bad laws on the books that are are perpetuating this. And a trial bar that is as rabid as any state in the country,” Brandes said.

All of this is happening as hurricane season approaches on June 1. A major hurricane strike could further cripple the insurance industry.

Governor Ron DeSantis' cabinet met Tuesday about the crisis. However, the Governor hasn't called for a special session on the issue as of Wednesday. He did say a special session was possible later in the year.

Florida’s cabinet met yesterday about the crisis but as of now, the Governor has not called for a special session on the issue.

“We are well beyond just tinkering around the edges. This thing needs a full overhaul,” said Brandes.

Even if new legislation is passed to deal with the rising insurance costs, it could take several months for the changes to show up in your bills.