TAMPA, Fla. — Florida’s insurer of last resort, Citizens Property Insurance Corps, hit a million homeowner policies this week, more than doubling their share of policies since the homeowner’s crisis in Florida began several years ago.

This is especially concerning to industry experts because the corporation also recently assumed a financial role in the Florida Office Of Insurance Regulation’s (OIR) new ‘Temporary Market Stabilization Arrangement,’ making it a backup funding source for companies whose financial stability ratings are downgraded by Demotech.

The concern for many is where all of this money would come from in the case of a catastrophic hurricane season in the state.

“It’s a fiscally unstable plan. It's very worrying,” the spokesman for the Insurance Information Institute, Mark Friedlander, told ABC Action News.

The OIR program was created in an emergency action to the possible downgrades of more than 20 insurance companies at the end of July. OIR said companies who take part will still be in compliance with federal mortgage loans because it's an exception for the required “A” rating from Demotech.

The arrangement states that Citizens assumes responsibility to pay for claims if a storm hits and a company goes insolvent or bankrupt. The Florida Insurance Guarantee Association (FIGA) will pay claims below $500,000 dollars, and Citizens will pay anything above.

We went to Citizens to ask how they’re able to take on such financial risk.

“That's a good question,” responded Citizens Spokesperson Michael Peltier. “The way the arrangement is set up is that Citizens would use its surplus, its $6.7 billion surplus, to back up claims that were, you know, that would, that would be maybe affected by an insolvency.”

He added, “We also go out to the reinsurance market and purchase additional reinsurance to increase our claims-paying ability. Right now, we've got about $13.4 billion in claims-paying ability available in the event of a storm.”

That’s a total of $13.4 billion dollars to cover this OIR program and Citizens' one million policies.

To put that into perspective, if those one million customers needed their homes repaired after a storm, Citizens said its “exposure” or risk of loss would be $346 billion.

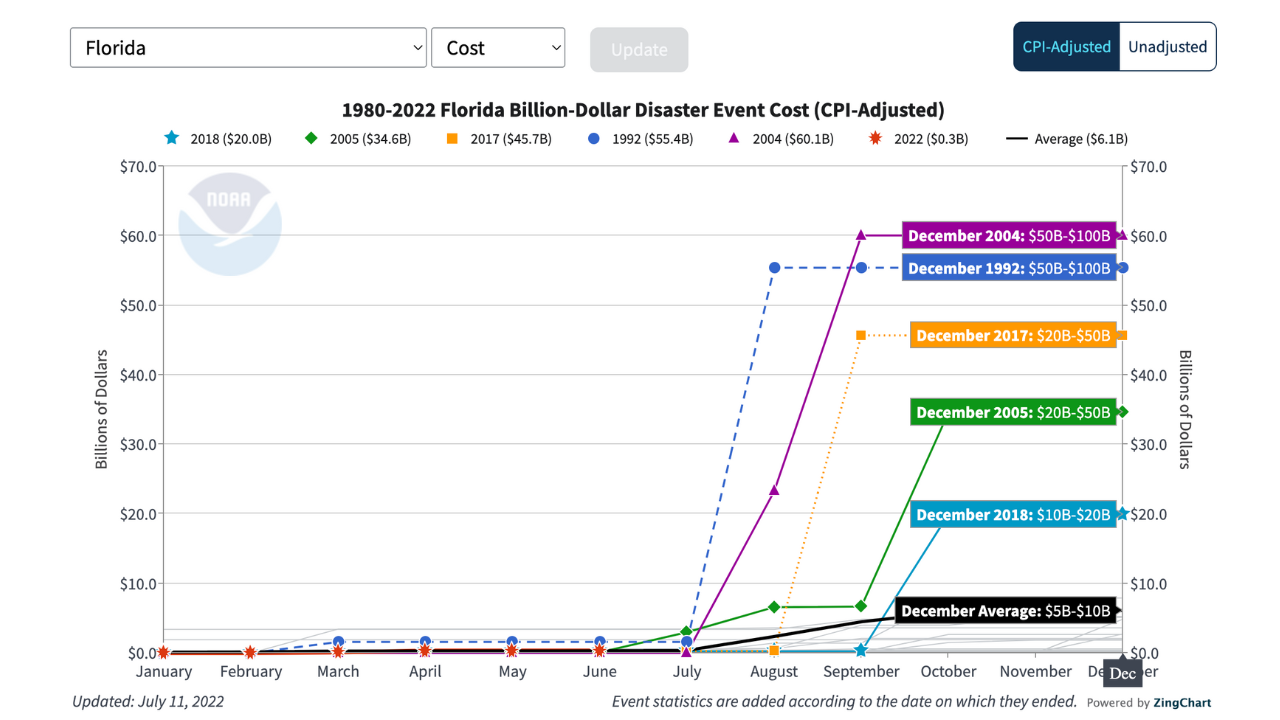

To get a more accurate idea of what a storm might cost, we went through Florida’s past price tags to cover major storms, with a large portion going to insurance claims.

The biggest storm to hit Florida was Hurricane Andrew in 1992. It cost $26 billion then, but with today’s prices, it’d be more like $47 billion.

In 2004, five storms made landfall, four of which were hurricanes, totaling more than $40 billion.

Then two more hurricanes hit in 2005 and cost an additional $20 billion.

More recently, Hurricane Irma in 2017 cost $50 billion, and Hurricane Michael in 2018 cost almost $19 billion.

“The issue comes in is if we have, you know, a storm season where one to three storms hit the state of Florida pretty well, and it wipes out all of Citizens reserves and has to start going through the process of assessments,” said Insurance Agent and Partner for Florida Strategic Insurance Mike Puffer.

“The reinsurance are the policyholders and the taxpayers of the state of Florida,” Puffer exclaimed

That’s why Citizens is referred to as “state-backed.” They were created by the legislature with the financial backup of the state taxpayers.

“In the event that… we expend all those funds, then we have the ability to — we have the required actually to take levy surpluses on our policyholders first and then levy assessments on other Florida insurance policyholders,” Peltier explained, adding that it’s something they always want to avoid.

So what exactly does that look like?

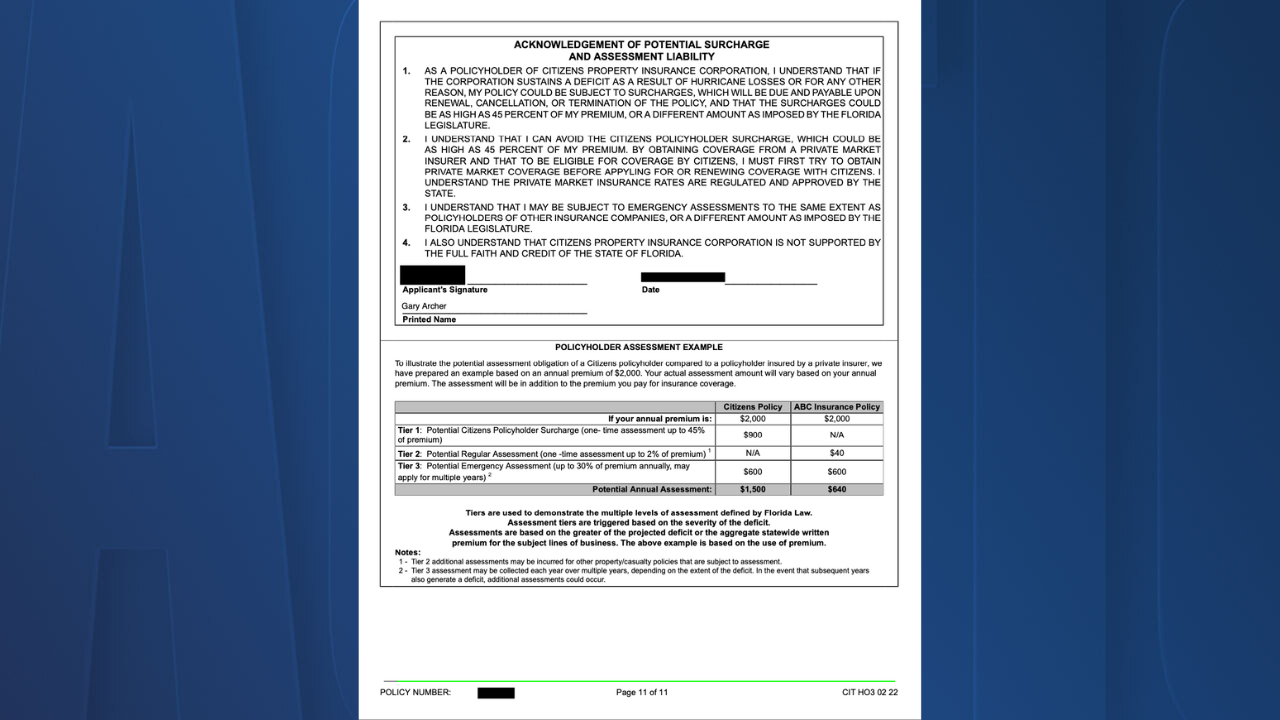

It starts with Citizens' policyholders. If Citizens needs more money to pay claims, their customers can be assessed up to 45% of their current premium.

If that’s not enough money, then Citizens can assess all homeowners in the state up to 2% through their insurance carrier.

If that’s still not enough money, then they can assess every insurance policy up to 30% for several years, that includes renters and auto insurance.

“There's something that we call the hurricane tax in Florida, which is also a surcharge, which means Citizens is allowed to put that on every consumer's insurance bill in the state of Florida, not just their customers,” Friedlander explained.

If you’ve lived in Florida for a while now, you may have paid it before.

“After the very heavy 2004-2005 season. We had an eight-year period where a 1% surcharge was put on insurance bills of consumers in Florida,” Friedlander said.

As for the consequences of not paying, customers could be dropped.

“We work with our insurance agents. We work with our customers,” Peltier exclaimed, “Ultimately… if premiums aren't paid, at some point, you know, coverage is dropped. I mean, insurance is something that you need to pay for.”

So far, only one insurance company has opted into this OIR temporary program. That is, United Property & Casualty Insurance (UPC) which was downgraded to an “M” meaning “moderate” by Demotech at the beginning of August.

Weston Property Insurance was declared insolvent and went into liquidation on August 8, which made it the third company this year to send its existing claims to FIGA, which is also financially supported by all insurance company’s policyholders.

There is still positive news. We asked FIGA’s Executive Director Corey Neal how many claims over $500,000 they’ve had with recent insolvencies. He told us, “FIGA rarely receives homeowners claims over $500,000 since the companies that write high-value homes tend to be well capitalized. There has only been one in the last five years.”

Citizens asked OIR to approve an 11% rate increase for their policies in January but was only approved for 6.4%. Policyholders can expect to see that coming.

The Insurance Information Institute said such a minimal rate increase would hinder Citizens from collecting funds to prepare for any storms. Friedlander said they’re now 80% below market value, and their rate increase should be closer to 37% in order to keep up.

Any surcharges explained above are only possibilities if a major storm or series of storms were to hit the state. In any case, Peltier said they do offer different payment plans for customers, so always call and ask what your options are.

RECOMMENDED: