TAMPA, Fla. — Skyrocketing homeowners insurance and insurance companies going under are what one state senator is calling a total collapse of the property insurance market in the Sunshine State. A crisis is largely due to roof scams.

Florida State Senator Jeff Brandes successfully petitioned to call a special session regarding the issue, and right now the Secretary of State is polling the legislature to see if there are enough votes in favor of holding that special session within the next month.

Since our last in-depth story on homeowner’s insurance, several people have reached out about their premiums doubling, even tripling across the state.

Mary Kilgore’s $140,000 dollar home in Lutz went from $2,400 dollars to $4,300 a year with Southern Fidelity Insurance.

Tonya Halvorsrod’s $395,000 home in Plant City made an even bigger jump with Tower Hill Insurance.

“Insurance has been $3,500 to $4,500 for the last 12 years,” Halvorsrod said. “Received the new bill in the mail last week at $8375.99.”

Halvorsrod said she called around and Farmers Insurance told her the price hike was because of the age on her roof—16 years.

“They told me that because our roof is shingled, and over 10 years old, that nobody wants to insure it anymore," she said. "So, we're in the process of having a metal roof installed, and the quote I got is for less than $3,000 a year once the metal roof is installed.”

She is replacing it herself for $15,000 dollars.

Insurance agencies confirm the homeowners' insurance market is the worst they’ve ever seen it.

“Sadly, for the most part, a lot of the private carriers are trying to get off risks,” Mike Puffer, a partner with Florida Strategic Insurance and Strategic Roofing, said.

When Valrico homeowner, John Hanson, received a notice from his insurance company, Universal, regarding the age of his roof, he had a roofer come out for an estimate.

He said the roofer found broken shingles in the back from a wind storm.

“They advised me to put in a claim with my insurance company to get that part of the roof replaced," Hanson said. "The insurance company originally rejected saying that they would fix just the broken shingles."

That would’ve been a $400 payout, but because his deductible was $2,500, he wasn’t going to get anything.

“When I informed the roofing company of that they asked if they could bring in a consumer advocate to help,” he said. “After some back and forth the insurance company agreed to replace the entire roof.”

That came out upwards of $20,000.

“I would have been happy… if they had said, 'Well, we’ll replace the back half of your roof...' When they said the whole roof, I thought that was maybe a little excessive, but I wasn't going to argue with them,” Hanson said.

Under state law, insurance companies don’t have much of an option. If more than 25% of a roof is damaged, they have to replace the whole thing, what’s known as replacement cost value (RCV).

“At this point in time, it’s become as crazy as I've ever seen it. I've been involved with it now for 40 years, our company’s been here… 72 years,” Tampa Bay Legacy Roofer, Doug Shields with Bill Shields Roofing, said.

“The attorneys get involved, the attorneys got a law that states if they recover $1 of storm damage, their attorney fees are covered,” he said, explaining how insurance companies end up paying the attorney’s $700-800 hourly fees.

These litigation costs have put seven Florida insurance companies in liquidation, with several others pulling out of the state, and for those remaining — their ratings are dropping rapidly.

“I got seven emails this morning from our service team of new non-renewals that our clients are going to be receiving due to the age or life expectancy of the roof,” Puffer said.

The insurance agency started its own roofing company to try and help clients replace roofs before getting dropped.

“One insurance company in particular that we write a lot of business with, in speaking with, the CEO was telling us that last year he averaged 26 lawsuits a day for roofs,” Puffer said.

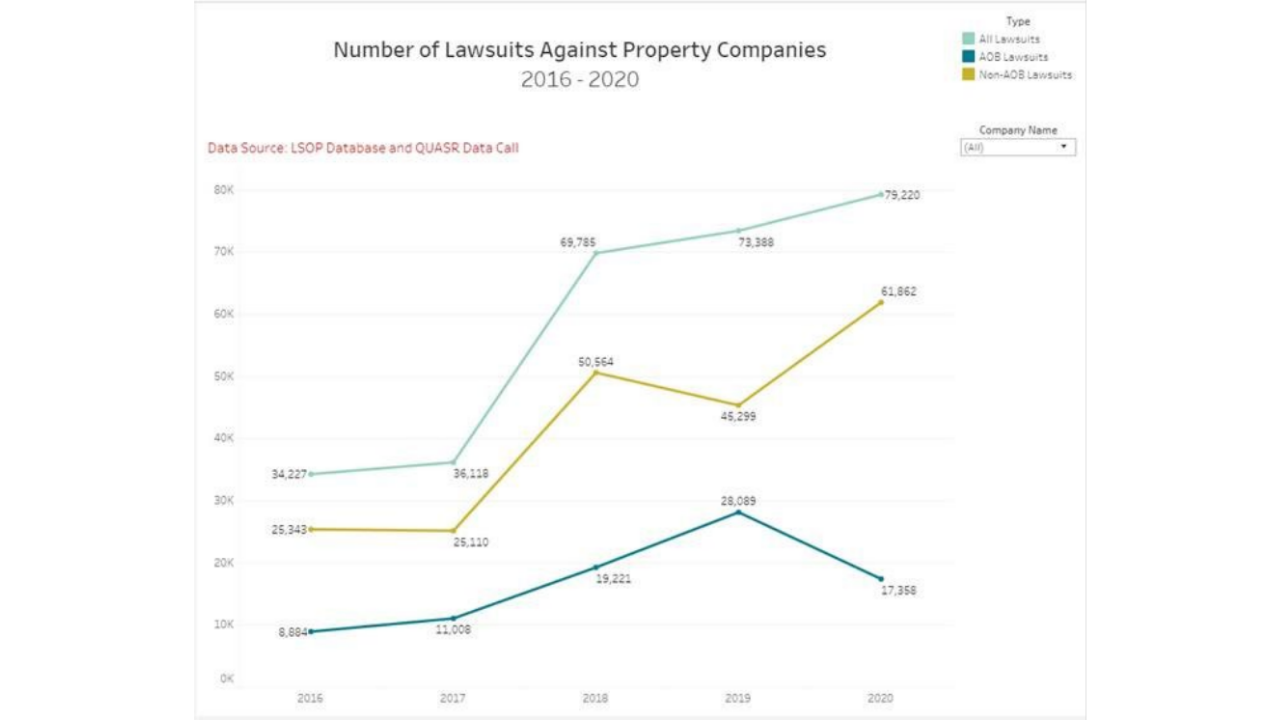

According to the Office Of Insurance Regulation, 79,220 lawsuits were filed against insurance companies in 2020 with underwriting losses of more than a billion dollars.

In addition, another survey called 'Florida’s P&C Insurance Market: Spiraling Toward Collapse' commissioned by the Senate Banking And Insurance Committee found that in 2019, 71% of the money awarded went to roofer attorney fees and 25 attorneys filed 33% of those suits.

“It’s very difficult to compete with those guys,” Shields said.

For example, Shields said he quoted a customer for a $14,700 dollar roof with no storm damage, but another roofer claimed storm damage in court and got $32,000 dollars from the insurance company.

“That's just not fair,” he said, adding their reputation keeps them busy, but it’s also gotten him recruited by one of these contractors.

“He said, 'you don't know how much you would make with your reputation, people would trust me so much more because of Shields Roofing,' and I said, 'Yeah, but I said then I'm caught up in the game that’s fraud,'” Shields recalled. “I said fraud like four or five times and the thing and he kind of laughed he goes, ‘I look at it like an opportunity.’”

Governor Ron DeSantis signed Senate Bill 76 which stops contractors from soliciting to repair roofs through insurance, but it’s still happening.

The Florida Department Of Business And Professional Regulation tells me the law hasn’t been enforced because of two current lawsuits — one based on freedom of speech.

The Office of Insurance Regulation stated in an email response: “While an injunction has been issued against enforcement of the portion of SB 76 pertaining to prohibited advertisements, all other components of the bill are in effect. Senate Bill 76 takes important steps to address the unique challenges facing the Florida property insurance market, address cost drivers within the market, and help stabilize rates for consumers.”

Puffer said his office is extremely busy trying to find insurance companies to take new clients and rewrite their policies. They’re writing about twice as many policies with excess and surplus providers, which includes any home valued too high for the state-subsidized insurance of last resort Citizens Property Insurance. That would be $700,000 and higher.

“Insurance companies are not writing business for the most part, anymore," Puffer said. "In this area, in Pinellas and Hillsborough County, a lot of them have shut down all of their new business operations. As an agency, I would say we're writing roughly 80 to 90% of our new business with Citizens.”

Citizens is now approaching a million policies and recently asked the state to approve 11% rate increases.

“When we speak with the representatives at Citizens, they don't want us to write business at Citizens,” Puffer added.

Puffer adds that the Office of Insurance just approved insurance companies to add roof-specific deductibles to policies.

“It really makes me mad because I pay my bills, I pay my taxes, and yet we're the ones who are penalized, but the scammers — they just get away with it,” Halvorsrod concluded.

Homeowners and insurance companies are waiting and hoping the legislature meets for a special session to change the law from replacement cost value to actual cash value.

The Secretary of State is currently polling the legislature. Results should be in by Tuesday, April 18.

If 60% vote in support, a notice of a special session will go out within seven days and will occur two to three weeks later.

The biggest concern is to get this done before another storm hits Florida.

“If there is a heavy storm season, I think you could see the collapse of the entire system,” Joe Petrelli, President of Demotech, the company that rates the solvency of insurers, told I-Team Investigator Jackie Callaway. A disaster could trigger the loss of even more coverage for millions of Floridians.

However, Puffer said another concern coming this summer will be when insurance companies apply for reinsurance in June and July. That is Florida's mandated insurance that insurance companies buy to support the risk they take on from covering homeowners.

“If an insurance company wants to continue writing business and reinsurance costs go up, they might be looking at taking more of the risk on the front and pushing their deductible a lot higher.”

As for Citizens, Puffer added that they also buy reinsurance, but not as much, so they have “the ability to assess their policyholders if they have a shortfall.”

RELATED STORIES