TAMPA BAY, Fla. — June 30 was the last day for Florida property insurance companies who opted into the state’s Reinsurance Assistance Program (RAP) to file for rate decreases.

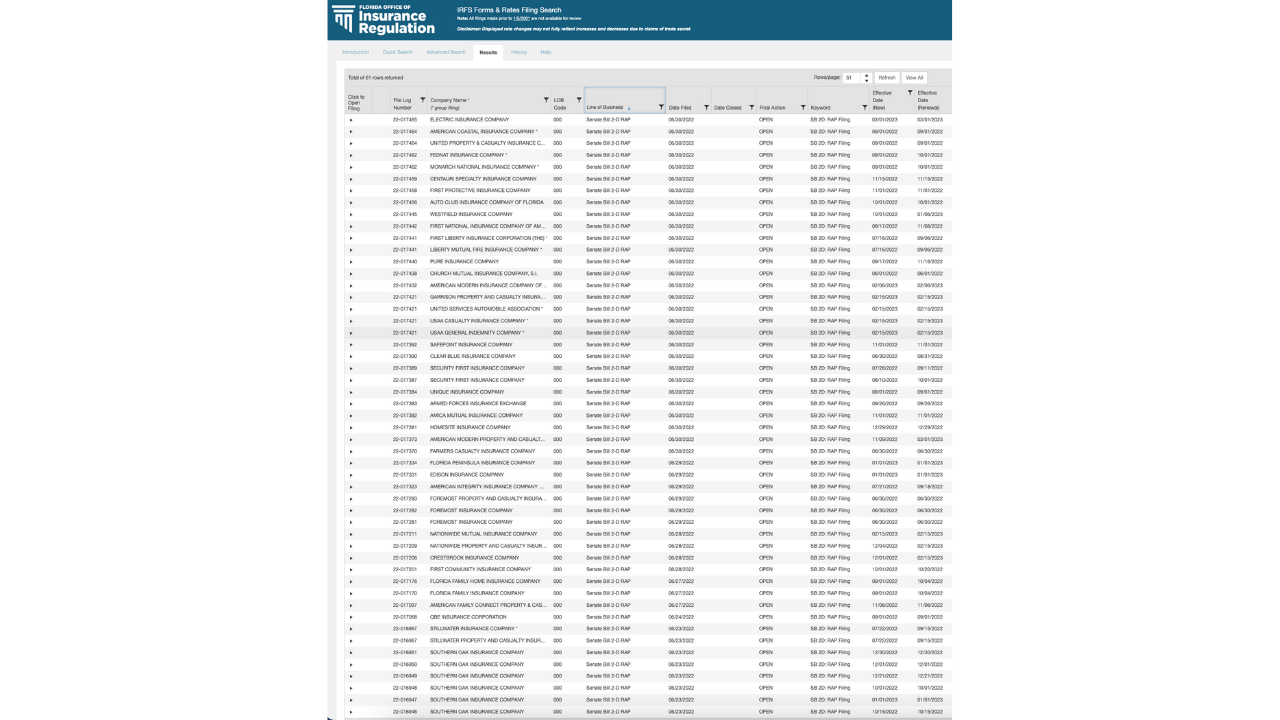

The Florida Office of Insurance Regulation (FLOIR) database shows 51 filings under the Senate Bill 2D RAP fund, from 44 separate companies.

This is $2 billion dollars made available during May's special session to help insurers obtain enough reinsurance for the 2022 hurricane season.

RELATED:

- Citizens insurance denied expected rate increases as more companies halt new policies

- Florida homeowners pay nearly 3x national average for homeowners insurance

- At least 1 Florida property insurance company unable to secure reinsurance by mid-June

- Home insurance groups continue to drop Florida policies as lawsuits, scams spiral out of control

- Florida Gov. DeSantis signs property insurance legislation

Under the bill, this now means that between this year and 2023, these companies will have to reduce customer's premiums to reflect the company's savings from the program.

This could be up to 4%, but one insurance company CEO said its decrease will be closer to 2%. The CEO added that premiums will still go up in the future due to how much it costs to get the rest of their reinsurance packet from other financial institutions.

To view the filings, status, and effective dates, click here and follow these steps:

- Click the “Advanced Search” tab at the top of the page.

- Select “Property & Casualty”

- In the Keywords box enter “SB 2D: RAP Filing” and hit search.

We are still waiting for information on the status of all Florida companies obtaining reinsurance.