LAND O' LAKES, Fla. — Do you use an ATM to deposit checks?

If so, you probably didn’t know that the signature on the back doesn’t always have to match the name on the front.

One local businessperson learned this the hard way when checks made out to his company were deposited into an employee’s account at a different bank.

The ABC Action News I-Team uncovers even more unsettling information about how little recourse you have when a check made out to you doesn’t make it into your account.

Review of accounts reveals missing checks

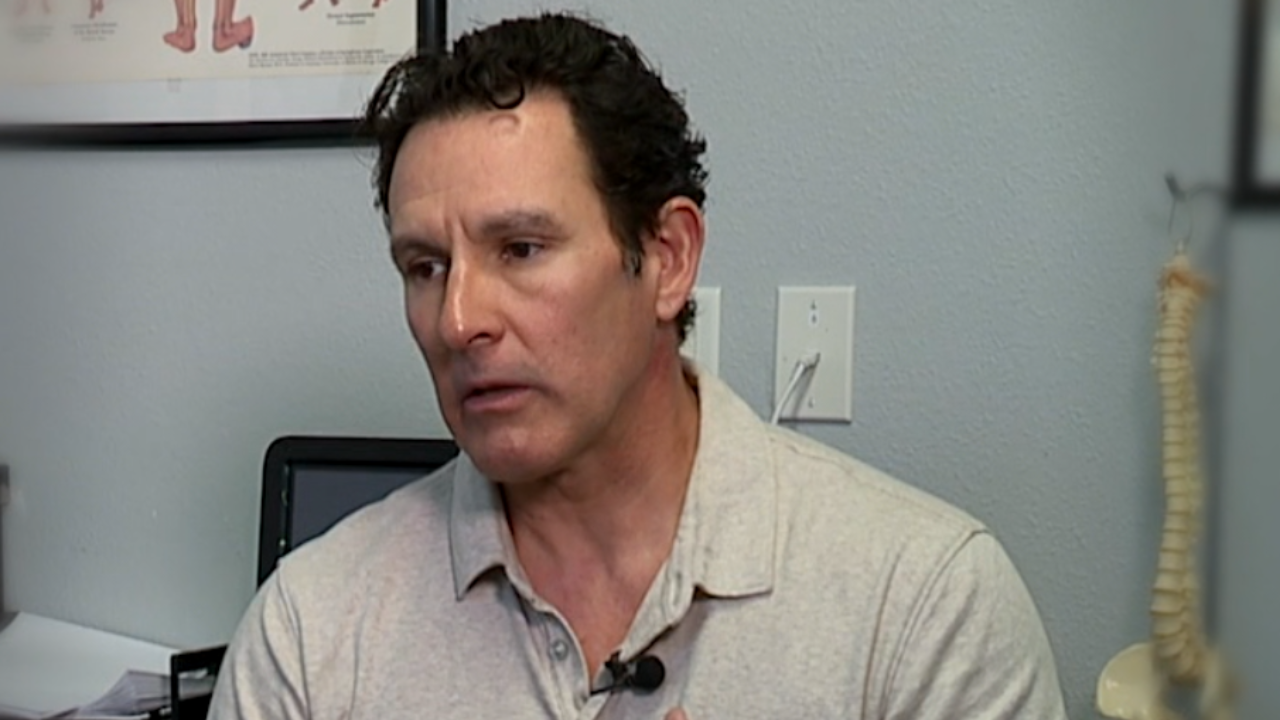

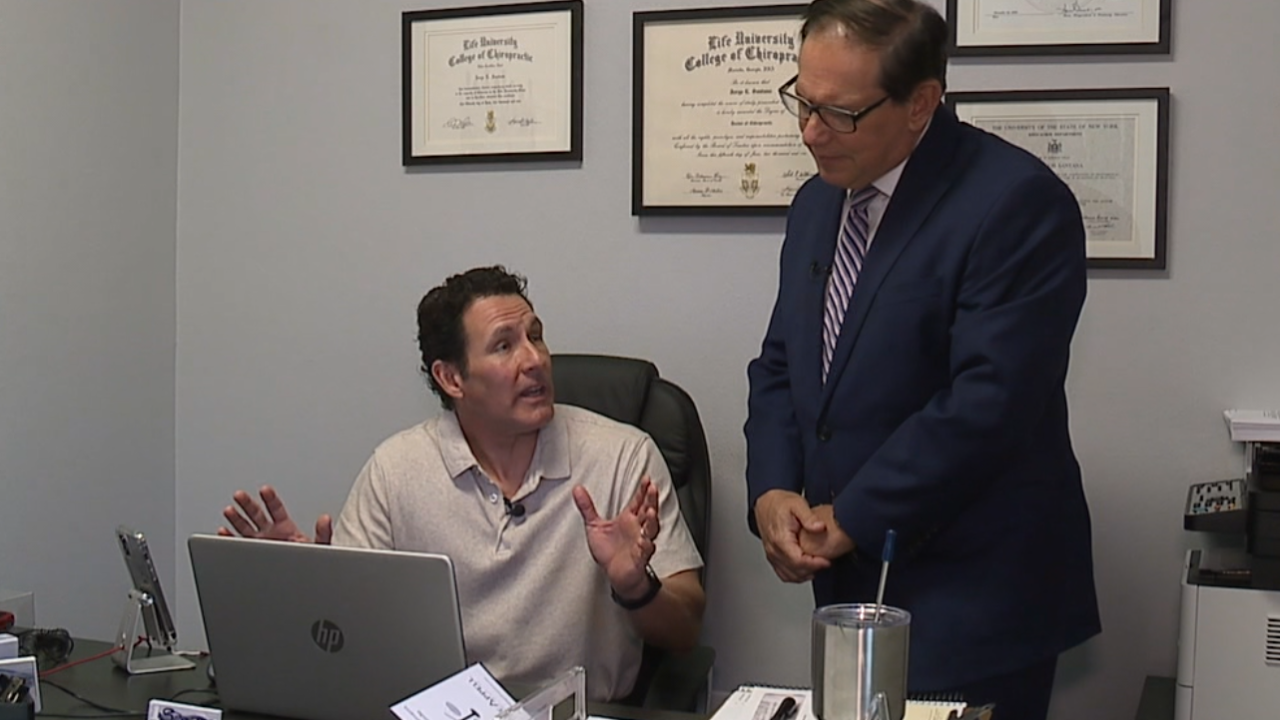

At the 1 Source Chiropractic Clinic in Land O’ Lakes, Dr. Jorge Santana focuses on treating patients' aches and pains.

His small staff runs the front office, booking appointments, ordering supplies, paying bills and accepting payments.

Last year, a staff member noticed insurance checks were missing.

“Some of the accounts weren’t matching up correctly, accounting-wise,” Santana said.

When the insurance companies were contacted, they responded and said the checks had been mailed in and deposited, so Santana requested copies.

“When we got that copy, on the back, it was endorsed by our former employee,” Santana said.

Santana’s staff identified 15 checks totaling $9,000 endorsed by the former employee and deposited at Wells Fargo Bank.

But the clinic’s business account is at Regions Bank.

“We got a detective involved from Pasco County and he was like, give me all your information. Let me dig deeper into this,” Santana said.

$50,000 in checks deposited using Wells Fargo ATM

Two months later, the detective found Santana undercounted.

He found 82 checks totaling more than $50,329 that never made it to Santana’s business account.

“The employee was getting the checks, endorsing them with her signature, then going through the ATM at Wells Fargo,” Santana said.

The Pasco County detective confirmed that the State’s Attorney’s Office now has the case, but the former employee has not been charged.

Business owner discovers he is “out of luck”

“Once they know that it’s not one of their business accounts, they look at the back and they see someone’s personal signature on a business check to me, that would be the first red flag, right?” Santana said.

Santana went to the branch where it happened and talked to the manager, who referred him to a corporate security supervisor.

“She came back to me and she told me this isn’t Wells Fargo’s fault, and there’s nothing we can do,” he said.

We went to Wells Fargo and talked to the manager, who referred us to a corporate spokesperson.

She declined an on-camera interview but said in a statement, “If a business does not receive an expected payment, the business needs to go to the party who wrote the check and file a claim with that party’s bank. If there are issues with checks we accepted for deposit, the issuing party’s bank notifies us for any resolution.”

In an email to Santana, Wells Fargo said, “Our liability for these checks, if any under the Uniform Commercial Code, would be only to the bank on which the checks were drawn and not to the maker or the intended payee of the checks.”

“It means I’m out of luck. It means they’re saying their responsibility is not to me,” Santana said.

The Office of the Comptroller of the Currency regulates Wells Fargo Bank.

A spokesperson said in an email that the office “does not comment on individual complaints, specific banks or supervisory activities,” but on its website, the office says, “generally a bank is liable for accepting a check that has been… improperly endorsed” and the bank may be required to reimburse you “if you can show that the bank failed to exercise ordinary care in handling the check.”

Who’s responsible depends on multiple factors

“The ways that banks handle checks depend on a lot of different factors, including how big they are, the way they are deposited those sorts of things,” said University of Alabama Law Professor Julie Hill.

Hill teaches banking law.

She said banks are supposed to verify endorsements, but businesses should also have policies to prevent check thefts.

“As soon as a check comes into a business, they want to endorse that 'for deposit only' with their bank account and bank account number,” Hill said.

Santana filed complaints with federal and state agencies and said he’s learned a very expensive lesson.

He believes Wells Fargo Bank should learn something too.

“I know they weren’t involved in it, they weren’t accomplices or anything like that, but they should have stopped it immediately,” Santana said.

Here is the entire statement from Wells Fargo Bank:

We want to do everything we can to combat fraud, protect consumers and support fraud victims. To protect the safety of all customers’ accounts, we are unable to provide you specific details of our investigative process or progress, but we will share that information with law enforcement as appropriate.

We remind business owners to monitor their accounts on a regular basis, and if they do not receive a payment, to file a claim and report the incident in a timely manner to the organization making the payment.

The process banks follow when it comes to check deposits is governed by law and the bank’s agreement with its customers. If a business does not receive an expected payment, the business needs to go to the party who wrote the check and file a claim with that party’s bank. If there are issues with checks we accepted for deposit, the issuing party’s bank notifies us for any resolution.

If you have a story you’d like the I-team to investigate, email us at adam@abcactionnews.com.